Insurance Process After a Storm

So what do you do?

- Call your local contractor and have them do a thorough inspection of your home.

- Call your insurance company and begin a claim.

- Your insurance adjuster will come, meet with your contractor, and assess the damage.

- You will receive the insurance company's scope of damage and, if the claim is approved, the first check.

- You will give a copy of the insurance scope to your contractor as well as the first insurance check.

- The contractor will go over the scope and submit needed supplements to your insurance company

- Your contractor will go over with you the materials that you will need and you will select the brand & color.

- Needed permits are pulled, and materials are ordered, and will be delivered to your home.

- Crew is scheduled, and the work is completed.

- The contractor will contact your insurance company to release the final payment.

- The job is inspected and signed off on by the city/county where the permit was pulled.

That is the basic process. Each job is a little different, and some are more complex than others, but that is what your contractor is for. Who your select is up to you, however do not make the mistake of selecting the lowest "bid" out there. Pick one that your can trust, that does good quality work.

Most Asked Questions

Q: If I file a claim, will it raise my rates?

An insurance claim for storm damage is considered an "ACT OF GOD". Insurance can not raise your rates for this, however if many, many claims in an area are filed, everyone's rates may go up. Likewise, if you do NOT file a claim and all of your neighbors in an area do, your rates may still go up, and if you have damaged property, it will stay damaged unless you pay for it out of pocket yourself. Another thing to remember is that many insurance companies only allow for up to one year for you to file on a storm damage claim, so you do not want to miss your opportunity to file.

Q: If I file a claim, can I just keep the money?

You can keep the money, however most insurance companies depreciate the value based on the age & condition of your home. This may be a significant amount that you would be forfeiting. Also, your insurance company will not pay for the same damage twice. So if you get another storm with more sever damage, they will not pay for it unless the damage has been repaired the first time. So you might be able to keep the money, but you are stuck with damaged property.

Q: Should I go out and get several bids?

It is not necessary to go out and get several bids. Your insurance will only pay what is on your insurance scope. Most of the insurance companies use a software called Xactimate that has each item figured in with the industry standard prices for your area. Your contractor can supplement with them if they feel that a supplement is necessary and items were missed, such as if your current roof does not include code items such as rotten wood or ice and water shield.

If you select a contractor by the low bid, thinking that you might be able to pocket the rest of the money... You can't do that. Your contractor will submit their bid at the end of the job to your insurance company, and if the total is less than the insurance scope, That is what they will pay. And you will still be responsible for your deductible. The insurance company wants you to pick a contractor that your can trust, & that does good quality work.

Q: Can I get money back for my deductible if I let my contractor put a sign in my yard?

No. It is illegal for a contractor to offer incentives like offering to pay your deductible or giving you money towards your deductible for putting a sign in your yard or anything else in lieu of your deductible. By law, you and you alone are responsible for your deductible.

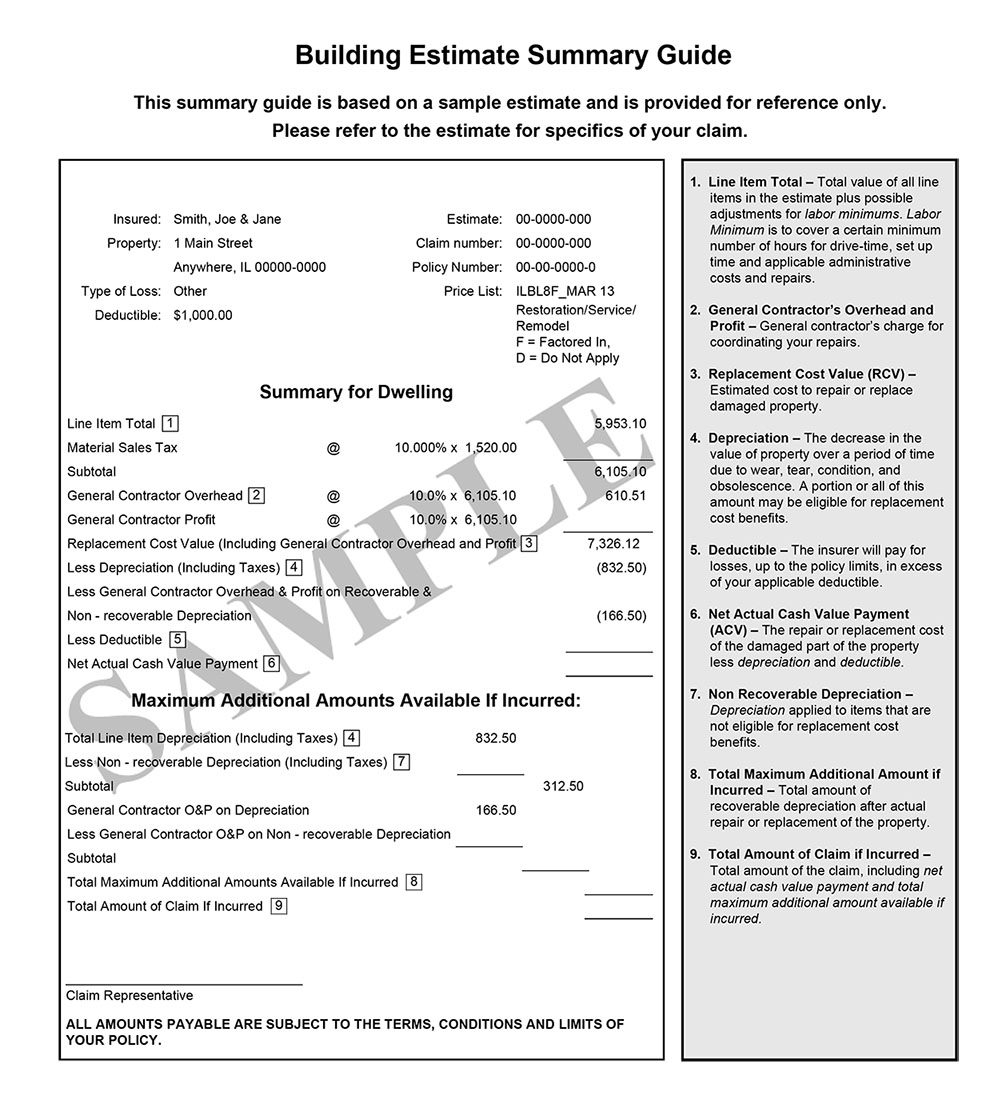

Q: What is the Difference between ACV and RCV value on the Scope?

RCV is the Recoverable Cash Value or the cost that it will take to replace the damaged item. The ACV is the Actual Cash Value that you will receive on the first insurance check. The RCV amount minus the ACV will be paid when the job is finished.

Q: What is the Overhead & Profit?

Sometimes the insurance company looks at the whole project. Overhead and Profit is allocated to the general contractor to cover all aspects of the project, and you can hire one company to do it all. The insurance company takes this all into consideration when approving overhead & profit. This amount is not your payout. It is for the general contractor for the extra work that he had to do. It is separated on the insurance scope as a separate line item. It is based on 10 percent for overhead & 10 percent of profit on allowable items.